What Your Choice of ETF Issuer Says About You as an Investor

Last Updated:

Investing isn’t a team sport, but if you spend enough time prowling Reddit or other corners of social media, you’ll notice something funny: miniature cults forming around certain ETF issuers or even specific funds.

I’m not going to name names, but if you’ve ever seen people talking about ETFs like they’re football teams, you’ve probably stumbled across one. Some of it borders on astroturfing. But I’m not the compliance department or FINRA, so what do I care?

For whatever reason, some investors gravitate toward one issuer over another. And over the years, I’ve noticed patterns - certain personality traits, beliefs, or quirks that seem to show up among fans of specific firms.

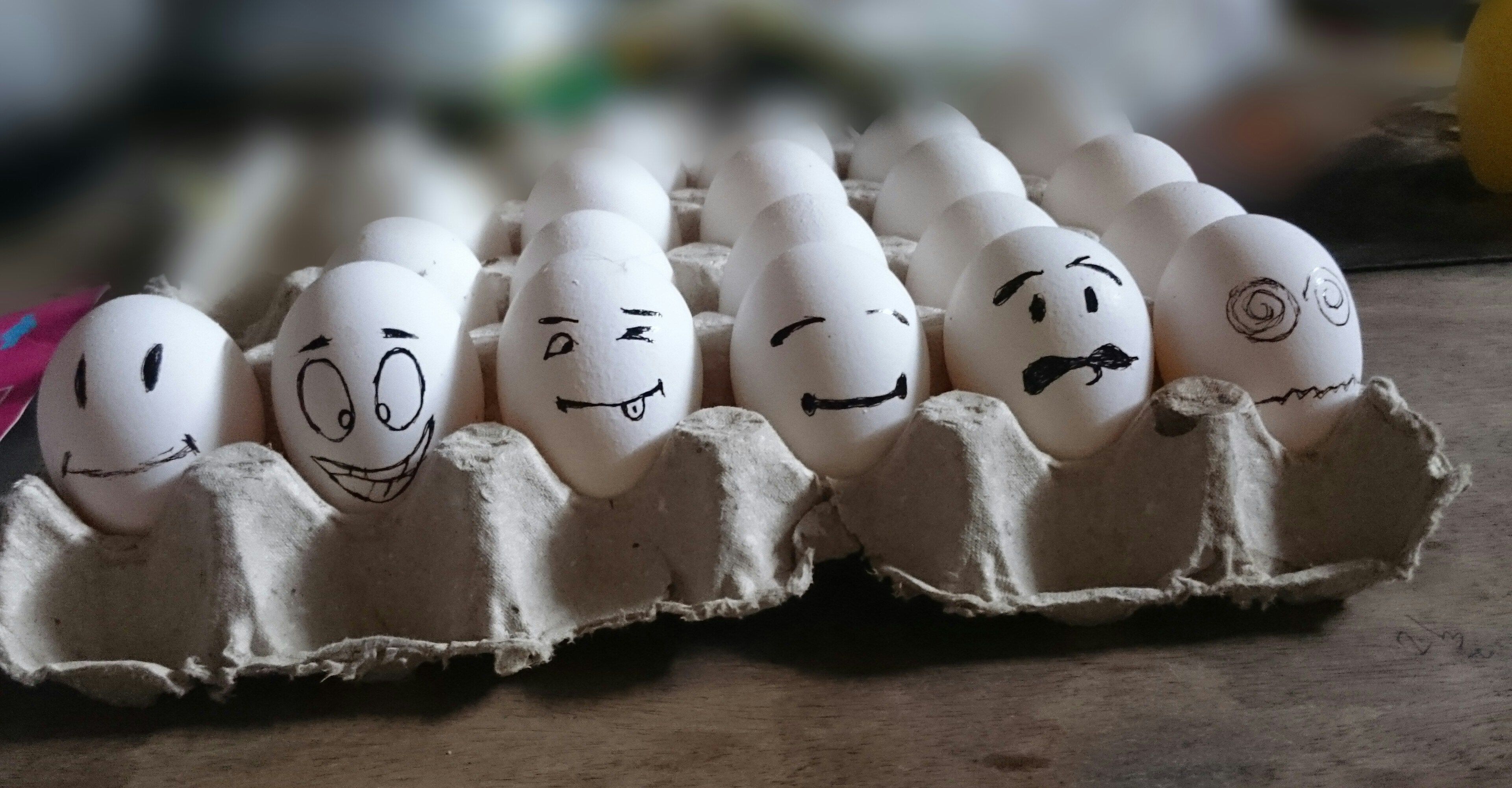

This isn’t data-driven or scientific. It’s just my observation. Your mileage may vary. So don’t grab the pitchforks, and please, try to keep a sense of humor. It’s an ETF, not your identity.

Vanguard

You're a regular on the Bogleheads forum, where you’ve written a dissertation-length post debating the merits of a 25% international allocation versus 30%. You’ve read Common Sense on Mutual Funds five times, have a John Bogle bobblehead on your desk, and once tried to expense it as a religious item. Your portfolio returns exactly the market average minus 0.03% and some tax, which brings you immense joy. But deep down, you sometimes wonder if you should’ve just bought Berkshire Hathaway and spent the last 20 years outside.

iShares

You’re not loyal so much as practical. You typed “best ETF” into Google, and BlackRock’s scale and liquidity reeled you in. You don't know who Larry Fink is and you don't care. You own ITOT or IVV and something that ends in “agg” and probably clicked through a Morningstar article once before deciding. You refer to your investing approach as “efficient,” but it’s really just “default settings.”

Global X ETFs

You like your ETFs like you like your memes: niche and oddly specific. You were first in line for uranium, covered calls, and metaverse ETFs, then swore off thematic investing entirely when they dipped 12%. You use the phrase “megatrends” in everyday conversation and get excited when someone says “future of infrastructure” or “AI picks and shovels.” If a theme’s been trending on Twitter, there’s a good chance you already bought the ETF and wrote a Substack post about it.

Invesco

You bought RSP once because someone on Twitter mentioned “concentration risk,” and you’ve been defending it ever since. You call yourself a contrarian but still own QQQ. You like the idea of equal weight because it feels democratic, even if the performance hasn’t exactly cooperated. Half your portfolio is legacy PowerShares funds from 2005 and the other half is just sitting in cash waiting for “a better entry point.”

State Street SPDR

You’re either an advisor with a Bloomberg terminal or someone who peaked in 2009. You chose SPY because you heard it’s “the most liquid,” and now you think limit orders make you a professional trader. You’ll defend 0.09% expense ratios to the death but pay $12.99 a month for three different stock picking newsletters. You consider sector rotation a hobby, even if your results say otherwise.

YieldMax

You describe your strategy as “monthly income” but what you really mean is “gambling with training wheels.” You hold 14 different synthetic single-stock ETFs and post screenshots of your yield in Facebook groups. You don't know what a synthetic covered call strategy is, but you can name the ex-div date of every Tesla, Palantir, or MicroStrategy income fund from memory.

Roundhill Investments

You treat your ETF holdings like baseball cards. You once bought the metaverse ETF because Zuckerberg wore VR goggles on stage, and you think eSports will “bounce back” any day now. You said “AI is the next oil” before ChatGPT was cool and now you’re eyeing space exploration and psychedelics. You’re not diversified, but you are enthusiastic.

Defiance ETFs

You picked your ETFs because the tickers looked cool and the names sounded like Marvel villains. You’re big on “disruptors” and once said “quantum computing” in a job interview without knowing what it means. Your portfolio is 100% conviction and 0% revenue-generating companies. But hey, at least it’s thematically aligned with your personality: edgy, misunderstood, and expensive.

VanEck

You’re the kind of investor who reads whitepapers “for fun” and owns gold miners, uranium stocks, and Brazilian fintech, all in one account. You pretend to hate marketing, but the words “moat,” “real assets,” and “long-term structural trend” still hit like dopamine. You don’t mind a bit of volatility as long as it’s smart volatility. If it’s not under-the-radar, you don’t want it. You were into commodities and semiconductors before they were cool and plan to stay long after they’re not.

First Trust

You like rules-based investing, but only if the rules are locked in a vault and guarded by three PhDs. You love factor ETFs, multi-factor ETFs, and whatever flavor of “enhanced alpha” First Trust is offering this quarter. You once clicked through their fund page and haven’t been the same since. That website looks like it was built on Windows 95 and optimized for Internet Explorer. But you’re not here for UX—you’re here for the dividend rotation strategy with the most acronyms.

Pacer ETFs

Your portfolio is 80% Cash Cows and 20% whatever the Pacer wholesaler at your local steakhouse lunch pitched last quarter. You’ve never read a methodology document but can recite the free cash flow yield of every sector from memory. Your wholesaler used to play tight end at Purdue and now drives a Tahoe full of slide decks and protein bars. You don’t mind that the strategy lags sometimes, because “at least it’s real earnings, bro.”

Amplify ETFs

You’re here for the vibes. Whether it’s cannabis or blockchain but with a twist, Amplify has your back. You tell people you’re an income investor, but what you mean is you bought DIVO and now think you understand derivatives. You like active management as long as it’s not boring and prefer ETFs that sound like startup names. There’s a good chance your Roth IRA has a fund that owns stocks and crypto and options, and you think that’s a feature, not a bug.