The North American Dividend Growth ETF Portfolio (1.25x Leveraged Edition)

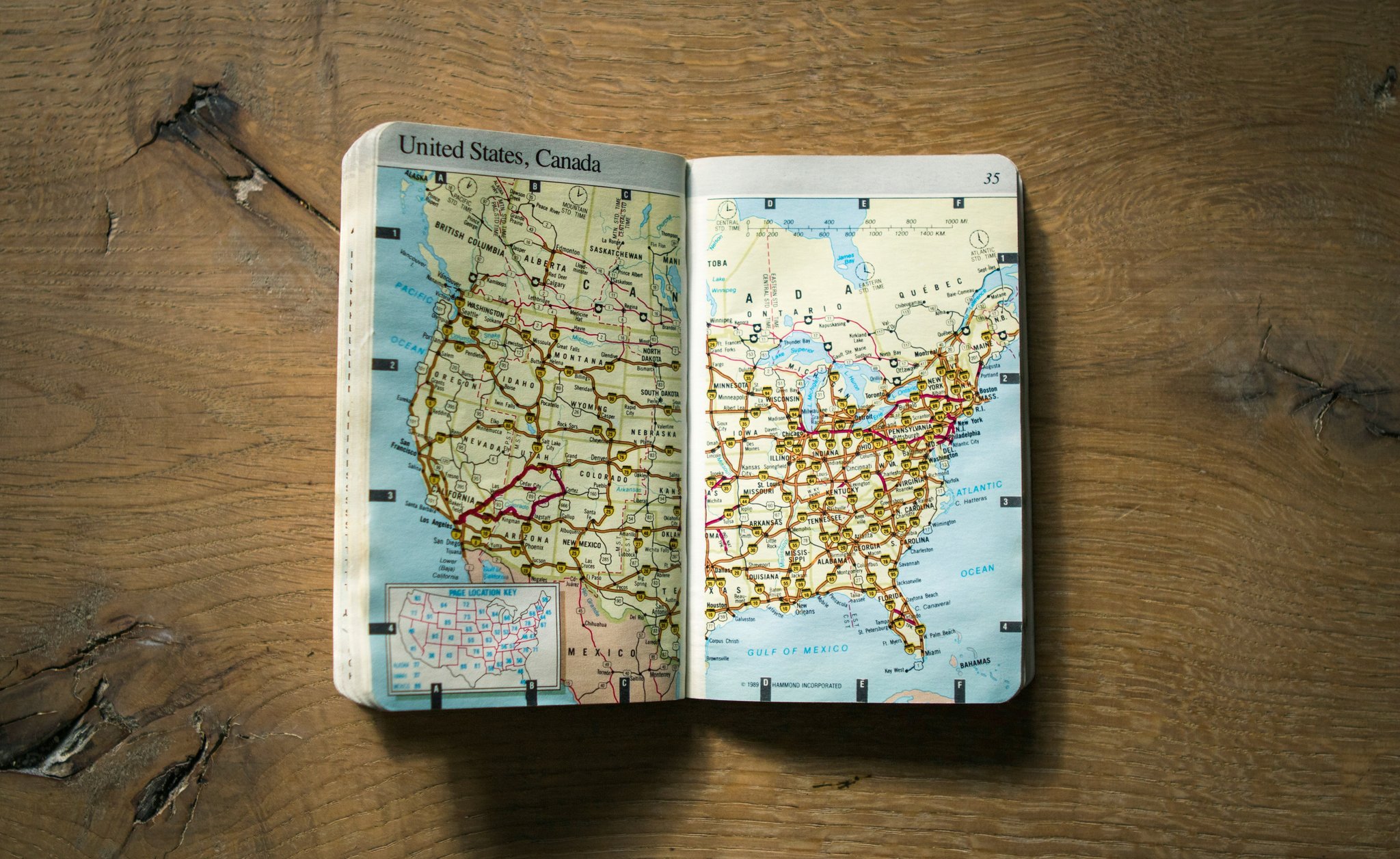

By applying conservative leverage to high-quality U.S. and Canadian dividend growers, this ETF portfolio aims to scale income and returns while retaining eligibility for registered accounts.